How does KSEF work? Guide

The National e-Invoice System, i.e. KSeF, will soon (from July 1, 2024) become obligatory for all entrepreneurs. However, huge companies that process larger invoices should be quick to use it. So, let’s check how KSeF will work from their perspective. We encourage you to check the most critical information.

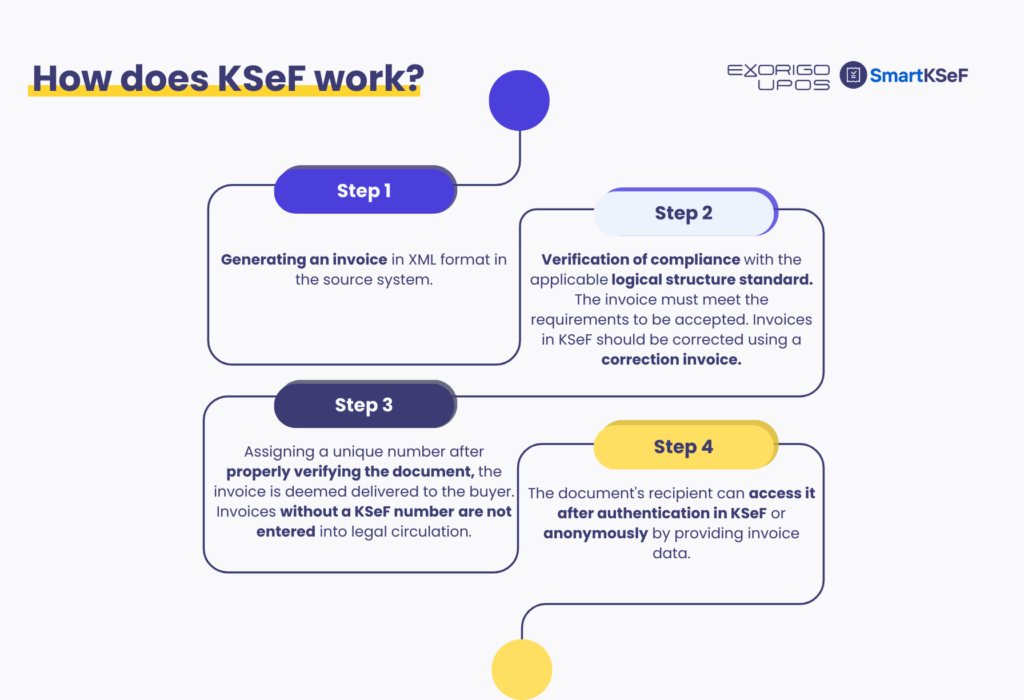

How does KSeF work?

The first step is authentication. It can be made using a qualified signature, a qualified electronic seal, a trusted signature or a token generated by KSeF. Importantly, KSeF can be used by natural persons and other entities. In the case of a company, however, it will be necessary to submit a ZAW-FA notification specifying the natural person dedicated to using the KSeF. Of course, you can also designate an entity, such as an accounting office, to issue or collect e-invoices on behalf of the company.

If the process is successful, we can issue documents. What does it look like?

- In the case of the National e-Invoice System, invoices are issued in XML format.

- They are successively verified by the system, which checks whether they comply with the applicable logical structure standard. Only invoices that meet the required format will be accepted, but please remember that KSeF does not match the formal and accounting correctness of the invoice. If the issuer makes a mistake and issues an incorrect invoice, he will have to correct it with a correction invoice because, in KSeF, it is impossible to cancel or withdraw a printed invoice.

- When the verification has been carried out correctly, the document is assigned a nationally unique number, and the invoice is considered delivered to the buyer. Importantly, invoices without a KSeF number are not deemed to have entered into legal circulation. If we want to provide the client with an invoice in the form of a printout or send a PDF file by e-mail. In that case, we should remember the planned obligation to include a unique verification code (QR code) on the invoice visualization, based on which the buyer will be able to check the authenticity and integrity of the document.

- Then, the document’s recipient has access to it after authentication in KSeF, which they can do, among others, by providing invoice details.

Need additional information? Find out what KSeF is and how we, as experts, help companies prepare for changes in invoicing.

What does this mean for large companies?

While using KSeF seems simple for small business owners who issue several to a dozen or so invoices a month, the process may be more complicated for large enterprises operating on thousands of documents.

In the case of large entities and retailers, the entry of KSeF usually involves comprehensive changes in IT systems and process redesign. All this is to ensure that company processes continue to function flawlessly. In such a situation, it is best to use solutions dedicated to large companies, such as SmartKSeF.

Our solution supports all types of e-invoices and enables efficient and safe processing of documents from many field systems. If KSeF is unavailable at a given time, invoices are queued, and invoicing attempts are repeated when KSeF is already operational. Possible errors are also detected at a very early stage, thanks to the validation of business rules and KSeF requirements. Thanks to this, even with thousands of invoices issued, you can ensure the process is carried out correctly.

Will it be possible to process invoices en masse?

In the case of large companies, mass document processing is likely to be possible. Yes, the system is adapted to large volumes of data sent as a single invoice and as a package of documents.

Would the operation of KSeF be a challenge for your company? If so, test software offered by the Ministry of Finance is now available. Invoices issued as a test or in Demo form will have no legal effects. This is an excellent opportunity to check the system’s functioning and how invoices are issued.

Go to the webpage https://www.exorigo-upos.com/omnicommerce-for-retail/

Go to the webpage https://www.exorigo-upos.com/omnicommerce-for-retail/