Entrepreneurs are arming themselves: KSeF during wartime

Recent years have not spared us from crises such as the pandemic or the war in Ukraine. Besides their evident impact on each of us, they also strongly affect the situation of entrepreneurs. In the face of many challenges they must confront shortly, the mandatory implementation of the National e-Invoice System (KSeF) is also looming. Taxpayers, informed by experience, are already asking questions about how the system will function in crises and what steps to take to best prepare for them today.

As of July 1, 2024, the National e-Invoice System (KSeF) will become mandatory in Poland. According to the RetailTech 2023 report, its implementation is currently one of the most significant challenges for almost 70% of surveyed businesses. The obligation of KSeF forces companies to make numerous changes that may require adjustments in processes and IT systems, as well as the proper preparation of employees. However, that’s not all. Entrepreneurs must also prepare for potential difficulties after the mandatory system is implemented.

Preparing for KSeF is stressful for companies and raises a series of questions, for which clear answers are sometimes difficult to find at this stage. Experiences from recent years have taught us that the market situation can be unpredictable. Therefore, it’s not surprising that entrepreneurs want to be ready for any, even the most unexpected, eventuality in managing their businesses. It’s important to know how to behave today – says Michał Sosnowski, Business Development Director at Exorigo-Upos.

KSeF in the face of war

Almost two years ago, a war broke out in Ukraine, which significantly also affected Polish companies. Companies engaged in trade with Eastern markets such as Russia, Belarus, or Ukraine were forced to modify or completely change their business models. This situation necessitated adapting to new economic and political realities.

In the shadow of these events, entrepreneurs wonder how to protect their businesses most effectively. Additional challenges include legislative changes, including implementing the National e-Invoice System. Can the system support entrepreneurs during a crisis, such as a war in our country?

In exceptional situations, such as war, when access to the Ministry of Finance systems may be restricted or even impossible, the taxpayer can issue an invoice outside the KSeF without registering it in this system. This is the only exception. In other situations, invoices must be submitted to the system within the statutory deadline – adds Michał Sosnowski.

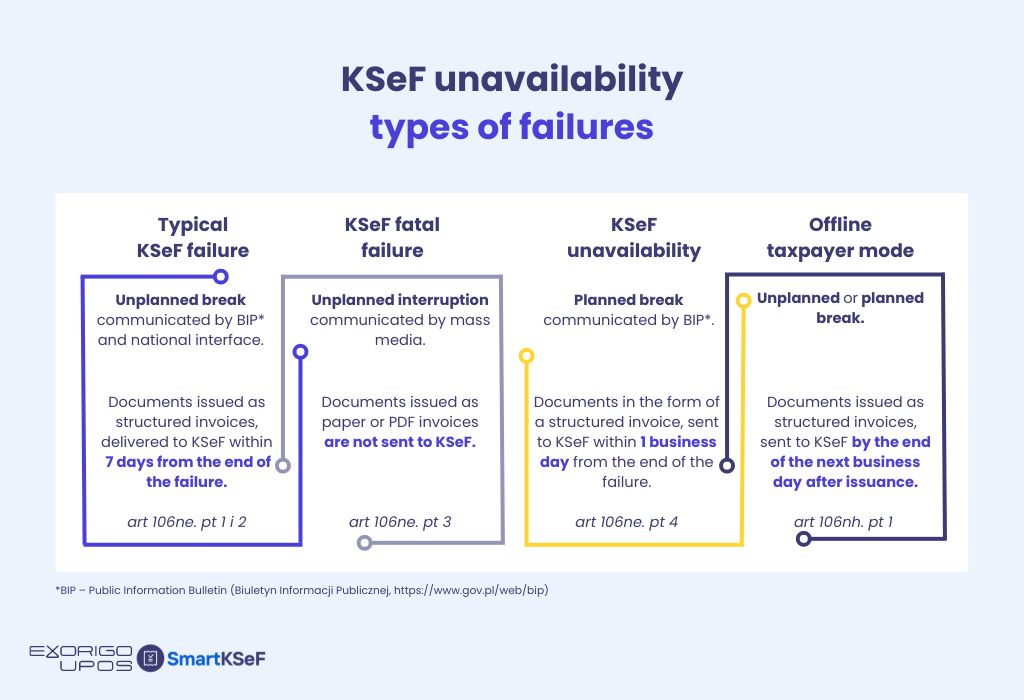

Failure, lack of access, or technical issues

Apart from extreme situations such as war or crises, less risky scenarios still raise many doubts. An example could be the National e-Invoice System (KSeF) failure caused by various factors, such as infrastructure failure, Ministry of Finance network disruptions, cyberattacks, or application errors.

Suppose the taxpayer cannot issue an invoice in the system. In that case, they can do so outside the KSeF in a structured invoice visualization (printed paper, electronic format, e.g., PDF). It must meet specific requirements, such as a verification code (QR code, which allows checking the integrity of the invoice), which includes at least the cryptographic hash/digest of the XML file of the structured invoice. Therefore, it is advisable to remember the created XML file to generate an invoice or a PDF printout.

If, when sending an invoice to the KSeF after the failure is resolved, even one character is changed (e.g., the file generation date), the cryptographic hash from the file downloaded from the KSeF will not match that on the invoice printout. The same should be done if the National e-Invoice System is unavailable due to a planned outage, such as administrative downtime or system update (made public).

Buyer purchasing systems should also be prepared for such actions. A printed invoice or a PDF file issued during a KSeF failure may reach the system before the customer downloads the invoice from the KSeF. In such a situation, after booking the paper or PDF invoice, the invoice downloaded from the KSeF should no longer be secured to avoid double booking. In practice, the reverse situation may also occur when the failure or unavailability of the KSeF is short-lived. In this case, the issuer could issue a paper invoice, but before it reached the buyer, it had already been published in the KSeF, downloaded by the counterparty, and booked.

Therefore, labelling an invoice issued during a failure or unavailability period with a particular marker is essential. It will facilitate the buyer’s correct handling of processing invoices from different sources. Additionally, in the planned new designs of the logical structure of the JPK_VAT, an invoice attribute appears to mark invoices issued during the KSeF failure and unavailability period and in case of system failure on the taxpayer’s side.

Companies know their ‘territory’ well and are usually prepared for unforeseen situations in their infrastructure but not necessarily for sudden incidents in external systems, which are elements of business processes. The assumption that, for example, KSeF will be available 24/7 or that KSeF will register each invoice in a second will sooner or later be tested by life for verification (usually faster than we think). Hence, the need for in-depth consideration of different cases and comprehensive testing of various scenarios – notes Michał Sosnowski from Exorigo-Upos.

Go to the webpage https://www.exorigo-upos.com/smartksef/

Go to the webpage https://www.exorigo-upos.com/smartksef/Read more:

About the SmartKSeF tool – for handling communication with KSeF.