Updated draft regulations on the mandatory KSeF – the most important changes

On March 15, 2023, the website of the government Legislation Center published an updated draft of regulations governing the introduction of the mandatory National e-Invoice System, which according to it, will apply from July 1, 2024. Familiarize yourself with the latest changes.

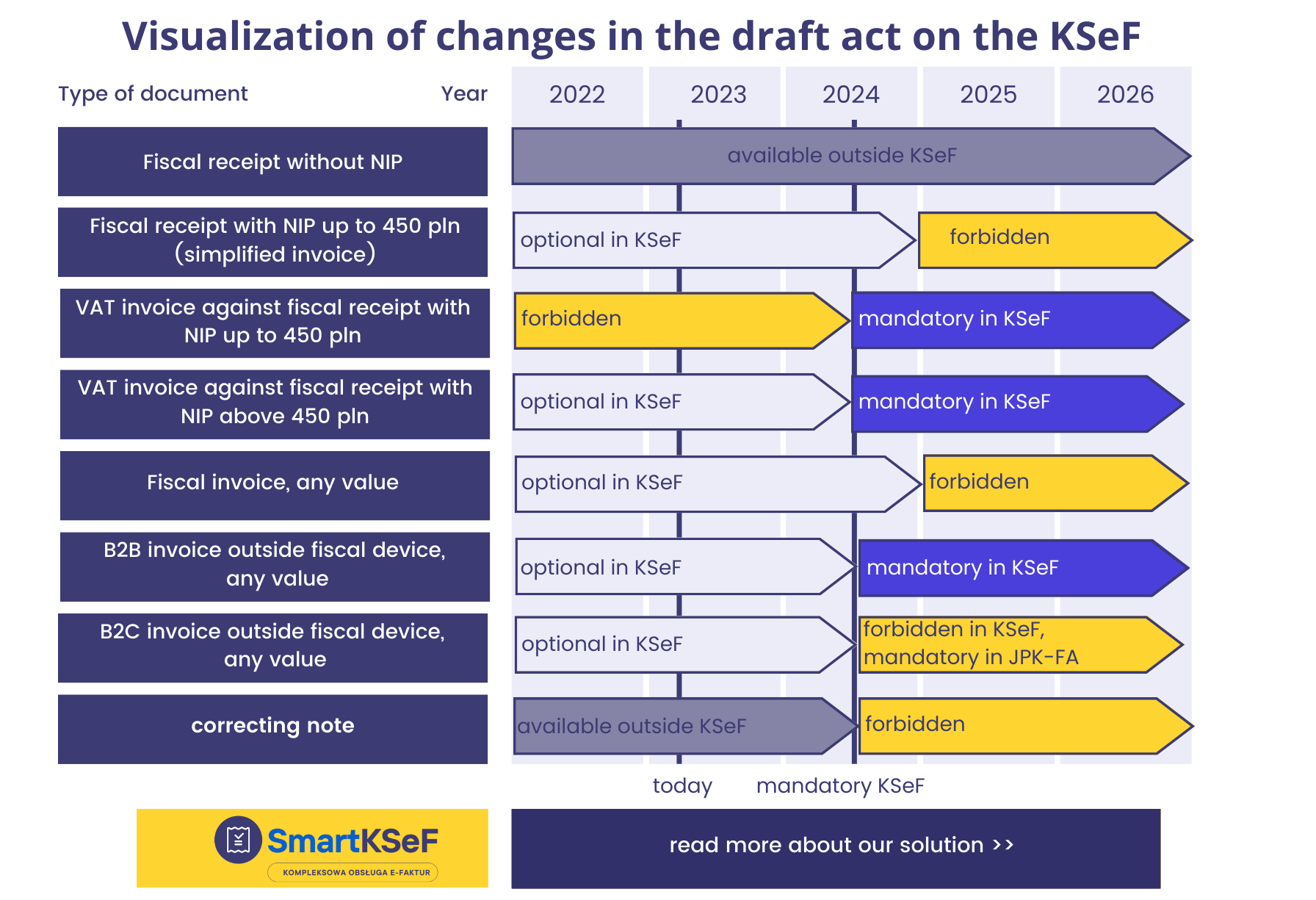

Voluntary issuing of invoices via KSeF by Polish entrepreneurs is possible from January 1, 2022. Currently, e-invoice, next to paper and electronic invoices, is one of the permitted forms of sales documentation.

The most important changes introduced in the project have appeared, among others, due to social consultations conducted by the Ministry of Finance. Several entities that participated in the talks related to KSeF proposed many simplifications and improvements in implementing the National e-Invoice System.

The most important changes introduced in the project:

- An earlier declaration regarding the mandatory National Register of e-Invoices transfer has been confirmed: it enters into force on July 1, 2024, for active VAT payers. On the other hand, taxpayers exempt from VAT will have half a year longer to implement the KSeF – for them, the date of the mandatory KSeF is January 1, 2025. With some exceptions, entities using special OSS and IOSS procedures were excluded from KSeF

- Issuing invoices from cash registers will be possible until December 31, 2024. From January 1, 2025, it will not be allowed (a VAT invoice to the receipt or an invoice outside the fiscal device will be necessary)

- Also, from January 1, 2025, a receipt with a NIP tax identification number up to PLN 450 will not be treated as a simplified invoice. In other words, a VAT e-invoice must be issued to the receipt for any amount (the obligation to issue an invoice only for the NIP number given on the receipt is still maintained).

- The KSeF obligation will not apply to: B2C invoices or tickets (including receipts on toll motorways). Consumer invoices cannot be sent to KSeF.

- The foreign currency exchange rate will be determined on the day preceding the date indicated in field P_1 of the invoice and not, as in the previous draft, based on the date of issuing the e-invoice (i.e., the moment of sending the document to KSeF)

- The changes consider the possibility of system failure on the taxpayer’s part. In such a situation, the taxpayer must issue an offline structured invoice and submit it to the KSeF on the next business day at the latest. The possible sanction for failure to comply with this obligation is 100% of the VAT amount from the invoice not sent on time.

- It will be possible to issue correcting invoices offline; the Act clarifies the rules for giving corrections to source invoices in and outside the KSeF.

- The possibility of issuing corrective notes in the KSeF and outside it will be eliminated. If it is necessary to change the data on the invoice, it will be required to issue a corrected invoice.

- The Ministry of Finance withdrew from the idea of the new functionality of the KSEF regarding the proposal of a correcting invoice for the buyer. In the case of an invoice correction, only the seller can issue a correcting invoice in KSeF.

- The sanctions will be milder and will apply from January 1, 2025. In the previous draft, the penalty for not issuing an invoice was fixed at 100% of the VAT amount, while after the change, the penalty will be moderated and will apply up to 100% of the VAT amount included in the invoice. Penal and fiscal liability for non-compliance with the obligations related to KSeF will be excluded.

- No need to issue an advance invoice if payment is received in the month of the payment activity.

- New KSeF functionalities were signaled, such as a QR code for checking an invoice issued outside the KSeF, generating a collective invoice identifier (for the same recipient) for payment for many invoices, marking a document in KSeF as a fake invoice (the invoice will not be removed from the Ministry of Finance register but specifically marked).

The draft act, together with draft implementing acts adopted by the SKRM, is available on the website of the Government Legislation Center in the Government Legislative Process tab.